State made $1.2 billion in accidental payments, which could be forgiven

This article is from Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism. Please join their free mailing list, as this helps provide more public service reporting.

When Matthew Bishop started getting Pandemic Unemployment Assistance a year ago, it pulled him out of a tight spot. Bishop, who runs a small company called Gutenberg Author Services, lost all his customers when the economy imploded in March, and had moved out of his group house and in with his parents because he couldn’t make rent. PUA was a lifeline.

But in April, the state told him he owes $20,000 because he was overpaid.

Tens of thousands of Ohioans could be eligible to have their debt to the Department of Jobs and Family Services for unemployment assistance overpayments wiped out. But when ODJFS tells people they’ve been overpaid, the notices don’t mention that a repayment waiver might be available.

That’s leaving people like Bishop in a panic as they stare down bills they can’t possibly pay. Bishop said he contacted both his Ohio representative and senator, and filed an appeal online, but he hasn’t gotten a hearing date.

“I don’t have a lawyer,” Bishop said. “I don’t really know what I’m doing.”

Over 1 million Ohioans have received PUA assistance. In the months since the system was launched, however, the Department of Jobs and Family Services found that it approved some people by mistake, or didn’t have enough paperwork to make a determination.

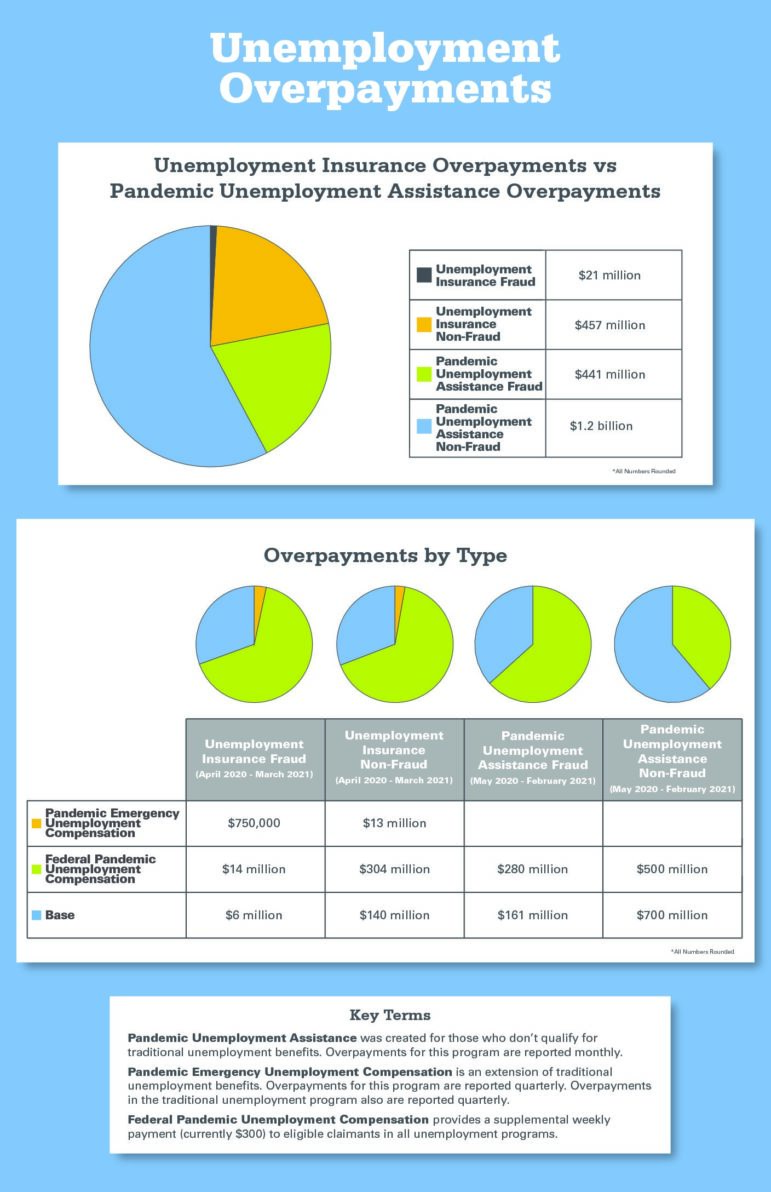

After seven requests for PUA overpayment data between March 12 and April 26, ODJFS spokesman Bret Crow said he expected data to be available in “a few weeks.” In a press conference announced Monday, ODJFS interim director Matt Damschroder said the state gave out $1.2 billion in accidental PUA payments between the launch of the system last May and February of this year. Non-fraud overpayments, Damschroder said, could include a case where someone wasn’t aware they were supposed to report any money they made each week, or where an ODJFS employee mistakenly waved through an application that had a problem. That’s not including fraudulent payments, where a claimant deliberately lied to get money they weren’t entitled to have.

The state has always had the option to waive overpayments for traditional unemployment insurance if the mistake happened on the state’s side, and the unemployed person would have trouble repaying. When the PUA program launched, the state didn’t have the same flexibility to forgive overpayments, but Congress changed that when it passed the CARES Act extension in December 2020.

Damschroder said ODJFS only received guidance from the federal Department of Labor about waivers recently, so Ohio is still sussing out what waiver requirements could be, or whether ODJFS will forgive some overpayments automatically through a blanket waiver. He said there will be more information about that “soon.”

Michelle Wrona, with Community Legal Aid in Youngstown, said many of the clients who ask her organization for help don’t know they can ask for a waiver. Every week, the state takes back half of the benefits they qualify for to pay down the overpayment balance. And, Wrona says, if they don’t clear the balance, they may not be able to get unemployment assistance for the next three years.

“That safety net is gone for years to come,” Wrona said. “We can’t have people three years out to the future after the pandemic still feeling the financial effect.”

According to Wrona, ODJFS officials told Legal Aid representatives early in 2021 that the agency would set up a formal process for requesting a waiver through their website. But, four months after Congress allowed PUA overpayment waivers, there’s still no formal pipeline. ODJFS didn’t answer repeated questions about whether it was still planning to institute a waiver process.

Rep. Lisa Sobecki proposed a bill in February to automatically waive any overpayment caused by a mistake by ODJFS, but the bill hasn’t moved since it was referred to the Insurance Subcommittee later that month.

For now, Wrona said, the best way to get an overpayment waiver is to log in on the ODJFS online portal, find a notice about the claimant’s overpayment status, and click an option to file a late appeal.

Jeri Lindner says that’s how she got her overpayment waived – though it wasn’t easy. She said she filed seven appeals before she was finally given a hearing date for February. After a ten-minute conversation with the hearing officer, she received a notice that her PUA balance had been waived. She got a notice that the waiver went through on March 10.

But that hasn’t put an end to her problems. Repayments are still being deducted from her weekly benefits.

“I have contacted [ODJFS] every day since, and I am starting back at the beginning,” she said. “No one knows anything.”

She said that one ODJFS representative she spoke to on the phone said she’d never heard of overpayment waivers and didn’t think they existed.

For people like Bishop and Lindner, Damschroder recommended patience.

“Certainly for individuals who have experienced an overpayment – again by no fault of their own,” Damschroder said, “as hard as it is to hear, the best thing I can say is, ‘Hold tight.’ We’re working on the policy.”

13 responses to “Do you owe ODJFS because of a Pandemic Unemployment Assistance overpayment? You might be eligible for a waiver”

I really don’t know what to do. They did a redetermination from around $56,000 overpayment to approx. $30,000. I never was told about a waiver. I have to appeal by 11/30 on this redetermination. But, they never sent me anything formal by mail or certified. I had cancer. Told to self isolate. I have documentation. My company closed the location I was at for sales and wanted me to go an hour an a half away. This really was a surprise. I feel stupid. I’m 66. I wanted to retire in Jan. But, doesn’t look like it. From what I’m reading, they will take my social security. I now have a shitty job that makes minimum wage. I just can’t afford to live.

Yes I have tried to call but I can’t go on line or website can’t get a hold of anyone! I kneed to do something about the unemployment offset taxes for 2020I kneed help!! I don’t know what to do

Did you file an appeal? The lady I just called today at odjfs of pua unemployment benefits. Stated to go to puaa.jfs.Ohio.gov and file the appeal you will need your claimant number along with your correspondence number which you can call 8776446562 and they will give you those things you need tell them you need to file an appeal to get them to not take your wages. Due to the pua unemployment saying you owe.

My name is Susan, I filed my taxes for 2023 and found out that they are keeping my state taxes because of an overpayment during the pandemic it’s over $27,000 they say I owe. i’ve made so many phone calls and got online and cannot find any help. I would appreciate if there’s any possible way you could help me at all. It would be so much appreciated thank you.

This thing is really happening. I received an offset letter from the Ohio Department of Taxation for collections. I was completely caught off guard: emotionally ambushed. I was on hold for hours trying to get to the bottom of it. Ohio Department of Taxation told me that it’s OJF Unemployment Insurance wanting 10 thousand in overpayment and to contact OFJ. I’ve been down a rabbit whole ever since! OJF Unemployment finally picked up and explained that I should login onto pua.unemployment.ohio.gov and try to file an appeal. The nice man also informed me that he did not have access to the PUA accounts. he also couldn’t refer me to anyone…..

I went to the pua.unemployment.ohio.gov, and found correspondences letters addressed to my old address. Now what??? Send help Jesus! No, I did not receive any mail about this matter other than my state tax offset notice. Where we just scammed?

Call 1877-644-6562 will help to get appeal I’d and correspondence # to appeal.

They said they over paid me from not fault of my own and they sent a offset letter couple weeks ago smh I barely have a job

I need help I file a appeal after I found out I owes state of ohio over $14,000.00 for overpayment which I didnt even receive that much for PUA!! now i call n cant reach anyone . what can I do now??

where can I get help?? I did appeal and it is more then a 40 days . This is very stressful, state of Ohio Attorney been taking my money I can’t afford it.. can someone one help me and point me to the right direction because I been calling everywhere.

I just received The same kind of letter saying I’m In The hole for $7000🤬!! I found My folder because I’m not a Tech savvy guy. So!I suppose tomorrow I’ll Call The # to Start fighting This Bullshit. I didn’t Get pua, it’s regular unemployment That My Boss Started My Claim. Unfortunately The business Went Under due to The “Shut Down 🙄. They can’t Get Money That’s Not Available!!

How do I get my confirmation nuber

Wow. I also received this offset letter from attorney general office. This is crazy. What do they expect us to do?? Smh.

Same happened to me couple weeks ago. Started with identity fraud. Had to send my Drivers license. Then, got ‘redetermination’ the other day. Says my identity is confirmed and not fraud. My claim is approved. However, I was overpaid pandemic assistance in 2020 and 2021. And please remit payment. My Account says that I still have about $8500 in unemployment funds available?? Why don’t they just take that!? This is so frustrating. I followed all the rules and guidelines. I was laid off for awhile. Had to wear the mask to work my limited hours (like 8 hrs a week) in the retail stores where I work. Off and on as government saw fit to change things on a daily basis. This week I could work while wearing mask. The next week, I could not work at all! Anyway, yes, same thing happening to me. I am filing an appeal and asking about the waiver. This is so strange. Can’t believe it hasn’t hit the news stations yet as ludicrous. How can they do this to people?