-

What can Ohio regulators do to prevent future utility corruption scandals?

More transparency, greater accountability and use of enforcement authority could help prevent corruption and protect ratepayers, advocates say. This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism, in partnership with the nonprofit Energy News Network. Please join the free mailing lists for Eye on Ohio or the Energy News…

-

What the guilty verdicts in the HB 6 corruption case mean for energy policy and good government in Ohio

Experts see the case against former Ohio House Speaker Larry Householder and lobbyist Matt Borges as a test of limits on dark money in Ohio politics. By Kathiann M. Kowalski This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism, in partnership with the nonprofit Energy News Network. Please join…

-

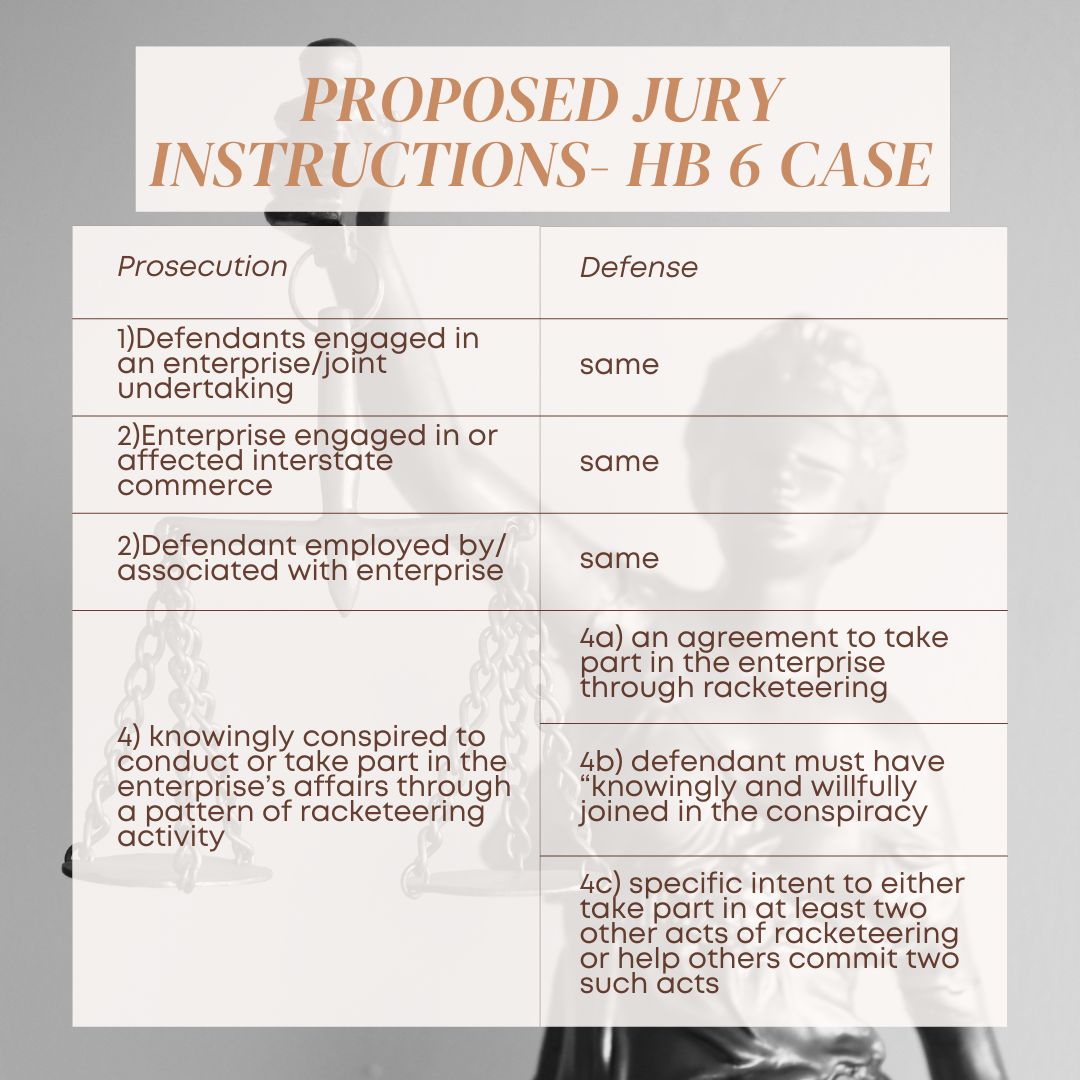

Householder seeks to sow reasonable doubt in Ohio corruption trial

The defendant in Ohio’s largest corruption case gambles by taking the stand. Whether it and other factors will counter elements of the government’s case remain to be seen. By Kathiann M. Kowalski This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism, in partnership with the nonprofit Energy News Network.…

-

Householder trial: New evidence shows depth of long-suspected scheme

By Kathiann M. Kowalski This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism, in partnership with the nonprofit Energy News Network. Please join the free mailing lists for Eye on Ohio or the Energy News Network, as this helps provide more public service reporting. Ohio’s largest corruption case continues…

-

Why attention to detail matters in the government’s HB 6 corruption trial

Opening argument last month gave a bird’s eye view of what the prosecution plans to show in its criminal case. Now the government is laying out the hundreds of puzzle pieces from which they hope jurors will see the big picture. By Kathiann M. Kowalski This article is provided by Eye on Ohio, the nonprofit,…

-

As Ohio regulators sit on coal plant subsidy cases, costs could rack up for ratepayers

Ratepayers are getting tiny credits right now, but House Bill 6’s coal plant bailouts have huge net costs. And millions of dollars of those costs were improper, critics argue. This story is a joint project of the nonprofit Energy News Network and Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism. Please join the…

-

Special counsel hired to help PUCO with document requests has multiple ties to HB 6 push

Links include an HB 6 co-sponsor, a lobbyist for FirstEnergy’s former subsidiary, and a former partner who served as an officer for Generation Now This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism, in partnership with the nonprofit Energy News Network. Please join the free mailing lists for Eye…

-

Freeze of regulator’s HB 6 cases could further harm Ohio consumers

A federal prosecutor’s move to stay PUCO cases would thwart investigations behind FirstEnergy’s spending and other matters related to Ohio’s ongoing House Bill 6 corruption scandal. This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism, in partnership with the nonprofit Energy News Network. Please join the free mailing lists…

-

Regulators’ foot-dragging on public records hides the full story behind Ohio’s utility corruption scandal

Documents produced at the end of July shed light on Sam Randazzo’s role at the Public Utilities Commission of Ohio. But more documents before and after his tenure still haven’t been produced. This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism, in partnership with the nonprofit Energy News Network.…

-

Former PUCO chair texted he knew FirstEnergy charge was likely unlawful, but company would keep money anyway

Texts about the $456 million charge may further undermine public confidence in the PUCO. This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism in partnership with the nonprofit Energy News Network. Please join the free mailing lists for Eye on Ohio or the Energy News Network, as this helps…