-

Why attention to detail matters in the government’s HB 6 corruption trial

Opening argument last month gave a bird’s eye view of what the prosecution plans to show in its criminal case. Now the government is laying out the hundreds of puzzle pieces from which they hope jurors will see the big picture. By Kathiann M. Kowalski This article is provided by Eye on Ohio, the nonprofit,…

-

Breathing easier in Cleveland: How Tighter Standards Could Change the City’s Air Quality Issues

This article provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism. Please join Eye on Ohio’s free mailing list as this helps provide more public service reporting to the community. By Christopher Johnston While running for Cleveland City Council Ward 3 seat last year, Ayat Amin spent a lot of time canvassing…

-

As Ohio regulators sit on coal plant subsidy cases, costs could rack up for ratepayers

Ratepayers are getting tiny credits right now, but House Bill 6’s coal plant bailouts have huge net costs. And millions of dollars of those costs were improper, critics argue. This story is a joint project of the nonprofit Energy News Network and Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism. Please join the…

-

Giving back? Charities laud Columbia Gas in $212 million rate hike case

Charity groups often depend on utilities for funds to do good works, but rate hikes by those utilities can impose more stress on low-income people the nonprofit groups serve. This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism, in partnership with the nonprofit Energy News Network. Please join the…

-

Dark money helped Ohio utilities subsidize coal plants, delaying climate action at ratepayers’ expense

The biggest corruption scandal in Ohio’s history happened right under people’s noses, and much of the law at its center remains on the books. This story originated from the Energy News Network and Eye on Ohio and is part of ‘Climate & Democracy,’ a series from the global journalism collaboration Covering Climate Now. By Kathiann…

-

Ohio cities settle civil claims related to power plant bailout

In a consolidated case, the Ohio attorney general’s office wants to move ahead on its civil racketeering case against FirstEnergy, Energy Harbor and others. This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism in partnership with the nonprofit Energy News Network. Please join the free mailing lists for Eye…

-

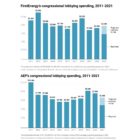

FirstEnergy and AEP still spending big on lobbying

Although FirstEnergy dialed back reported campaign spending in the wake of House Bill 6, the company spent $500,000 on congressional lobbying from July through September. AEP spent even more. This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism in partnership with the nonprofit Energy News Network. Please join the…

-

FirstEnergy, DeWine’s office and others still far from full disclosure on HB 6

Roadblocks at the Public Utilities Commission of Ohio, in Gov. Mike DeWine’s office and elsewhere could make it harder to prevent future corruption. This article is provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism in partnership with the nonprofit Energy News Network. Please join the free mailing lists for Eye on…

-

Ohio bill to reform electric rates aims to preserve coal plant subsidies under attack in wake of corruption probe

A plan to end Ohio’s long-criticized Electric Security Plans comes from a primary sponsor of HB 6, the 2019 law at the heart of a $60 million corruption case. This story is from the Energy News Network in collaboration with Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism. Please join Eye on Ohio’s…

-

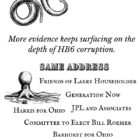

Utility and fossil fuel influence in Ohio goes beyond passage of bailout

Dark money loopholes remain, while people linked to utilities and fossil fuels hold public office or enjoy ongoing access to government officials. This article provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism in partnership with the nonprofit Energy News Network. Please join our free mailing list or the mailing list for…